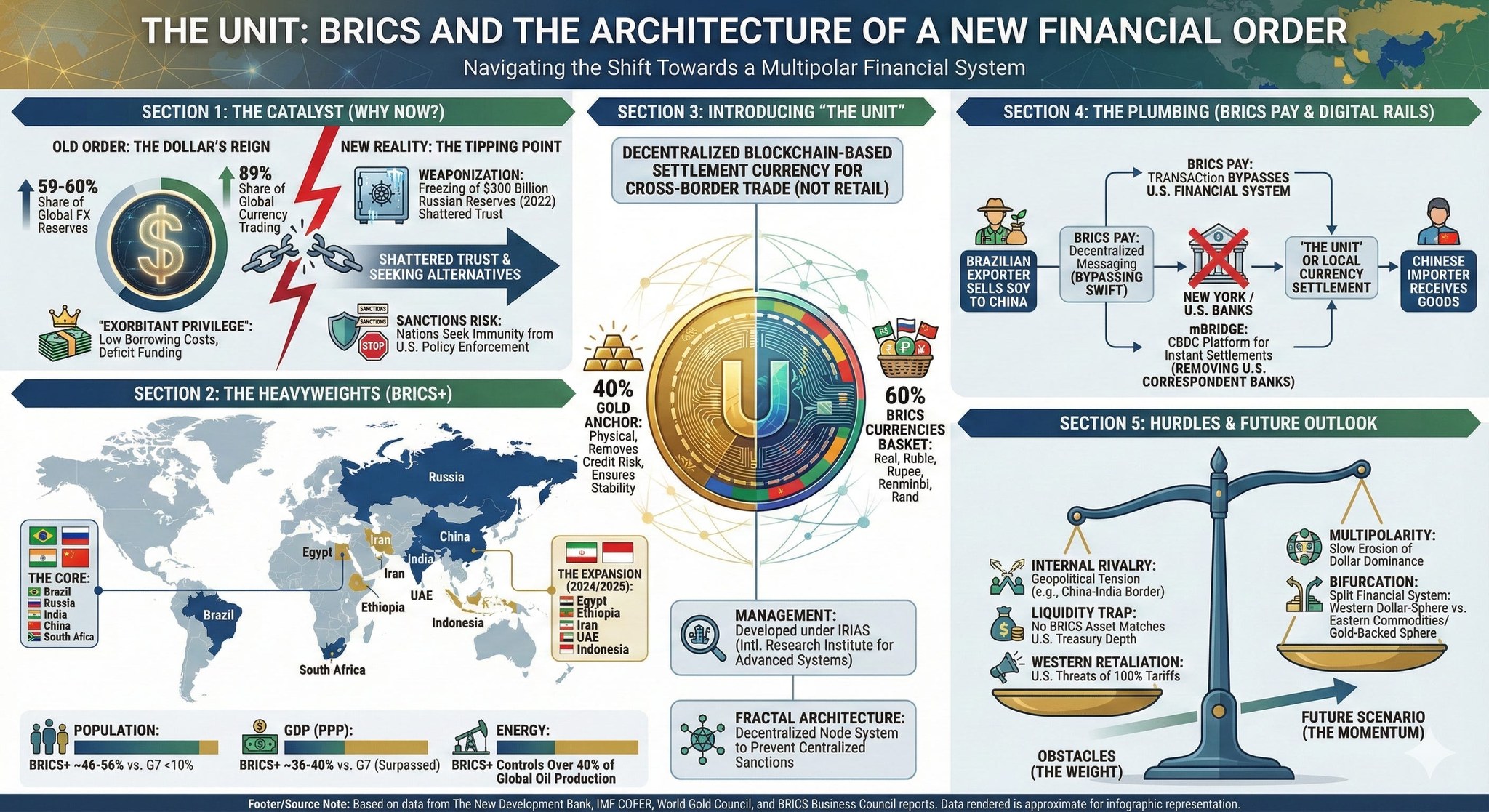

Due to the emergence of digital currencies and immediate banking and exchange over secure internet based systems, there isn’t (and probably won’t be) a single, unified “BRICS currency” used for daily transactions, but the group is developing a digital trade settlement unit, tentatively called “The Unit,” aimed at reducing reliance on the U.S. dollar for international trade, backed by gold and a basket of member currencies like the Yuan, Rupee, Real, Ruble, and others. This initiative, alongside increased use of national currencies for trade, represents a move towards de-dollarization, creating an alternative financial system, though a full replacement for the dollar remains a long-term, complex goal requiring significant economic integration.

In a nutshell, the Unit will be tied to a basket of commodities based on physical gold (and tied first to gold prices) and other stable items of exchange (oil, minerals, even grain) and then each BRICS nation will have the choice of tying the value of its currency to the Unit — or letting it “float” against the Unit as a fiat currency. Thus the Unit is also partially tied to “hard” national currencies tied to commodity prices. The Unit will not be a physical piece of currency, but a digital value. Since these countries now increasingly exchange with their own native currencies, all that is necessary if the messaging and exchange system and an agreement establishing the reserve of commodities by which the Unit will be valued.

Key Aspects of the BRICS Currency Initiative:

- “The Unit” (Digital Trade Currency): A pilot digital currency for settling trade between BRICS nations, designed to be a neutral settlement tool.

- Composition: Aims to be gold-anchored (40% gold) and backed by a basket of BRICS national currencies (60%).

- Purpose: To facilitate trade without the dollar, bypass SWIFT, reduce financial sanctions risk, and strengthen economic ties.

- Mechanism: Uses blockchain for immutable, instant transactions, locking local currencies and releasing the “Unit” tokens.

Why BRICS is Pursuing This:

- Reduce Dollar Hegemony: To challenge the U.S. dollar’s dominance in global finance and trade.

- Economic Integration: To enhance financial inclusion and efficiency among member economies (Brazil, Russia, India, China, South Africa, and new members like Egypt, UAE, Saudi Arabia, Iran, Ethiopia).

- Financial Stability: To mitigate risks from U.S. dollar volatility and potential unilateral measures.

Current Status & Outlook:

- The initiative is in early stages, with “The Unit” being a test platform for cross-border settlements, not a replacement for national currencies.

- Experts remain divided on its potential to become a major reserve currency, citing challenges in achieving macroeconomic convergence and trust.

- In essence, BRICS is building parallel financial infrastructure to offer alternatives, rather than immediately trying to overthrow the dollar.